Introduction: Overview of EMI Mobile Phone Purchase

Purchasing a mobile phone on Equated Monthly Instalments (EMI) allows consumers to acquire devices without the need for an upfront lump sum payment. EMI is a financial arrangement in which the total cost of the mobile phone is divided into smaller, manageable payments over a specified period. This system makes high-end models more accessible to a broader range of consumers, alleviating immediate financial burdens while ensuring ownership.

During the EMI purchase process, several factors must be considered, including the interest rate applied and the tenure of repayment. Interest rates can vary significantly between lenders and are often influenced by credit scores. Additionally, some retailers may offer zero-interest EMI plans as promotional offers, making it crucial for buyers to evaluate all available options before proceeding with a transaction. Understanding these elements not only aids in effective budgeting but also empowers users to make informed decisions tailored to their financial circumstances.

Buy Mobile Phone on EMI

What is EMI? Definition and Explanation

EMI, or Equated Monthly Installment, is a financial arrangement that enables consumers to purchase products through installment payments over a fixed tenure. Each EMI payment comprises both the principal amount and interest charged by the lender. This method allows individuals to manage their cash flow effectively by spreading out the cost of higher-value items, such as mobile phones, across several months rather than paying the full amount upfront.

The calculation of EMI Mobile is typically done using a formula that considers the loan principal, interest rate, and repayment duration. Various lenders provide calculators or tables that facilitate this computation for potential borrowers. An important characteristic of EMI plans is that they often vary significantly based on factors like credit score and loan terms; therefore, it is advisable for consumers to assess different offers before committing to a plan. Understanding these components can empower buyers to make informed decisions regarding their financing options when purchasing mobile devices.

Benefits of buy Mobile Phone Purchasing on EMI

Purchasing a mobile phone on Equated Monthly Installments (EMI) offers significant financial flexibility for consumers. By distributing the total cost over a predefined period, individuals can manage their cash flow more effectively. This method enables the allocation of funds to other essential expenses while still obtaining the desired mobile device immediately.

Moreover, many EMI plans include interest-free options or low-interest rates, which can result in less overall expenditure compared to traditional financing methods. This approach allows consumers to maintain their cash reserves for emergencies or unanticipated expenses, thereby enhancing financial stability. Additionally, certain retailers and manufacturers provide exclusive offers or rebates on EMIs that further amplify savings and incentivize purchases at favorable terms.

Also Read: 10 Strategies to Boost Focus by Reducing Mobile Distractions in 2024

Eligibility Criteria for EMI Approval

Eligibility criteria for Equated Monthly Installment (EMI) approval vary depending on the financial institution or retailer offering the EMI option. Typically, applicants must demonstrate creditworthiness through a favorable credit score, which is a numerical representation of an individual’s credit history. A minimum score threshold often exists—commonly around 650—but this can differ based on lender policies. Additionally, proof of income must be supplied to ensure that monthly payments can be sustained without financial strain.

Documentation requirements are also integral to EMI approval. Applicants are generally required to provide personal identification documents, proof of address, and income statements such as salary slips or bank account statements. Moreover, employment stability may be assessed; individuals with full-time employment or consistent self-employment history are more likely to qualify for favorable terms. It is vital for potential borrowers to review their financial records and prepare necessary documentation in advance to facilitate a smoother application process and enhance their chances of obtaining approved EMI financing efficiently.

Steps to Apply for buy Mobile Phone EMI Online Bajaj Insta Card

Step by Step to Apply for Mobile Phone EMI card

- Eligibility Assessment: Prior to application, check the eligibility criteria set by the financial institution or retailer. Common requirements include age (typically a minimum of 21 years), employment status, and credit score. A higher credit score may facilitate better loan terms.

- Documentation Preparation: Gather the necessary documentation for processing the EMI application. Standard documents include proof of identity (such as an Aadhaar card), proof of address (utility bill or rental agreement), and income statements (salary slips or bank statements). Ensure that all documents are current and valid.

- Application Submission: Submit the application online through the retailer’s platform or directly with a financial institution offering EMI options. Fill out all required fields accurately to avoid delays in processing. Review terms and conditions carefully before finalizing the agreement.

- Approval Process: Once submitted, your application will be evaluated based on your creditworthiness and provided documentation. Approval timelines can vary; applicants are advised to follow up if no notification is received within a stipulated period.

By adhering to these steps, prospective buyers can navigate the mobile phone EMI process efficiently while ensuring they meet all necessary requirements for successful approval.

Follow the steps to apply Bajaj Insta Emi Card Online

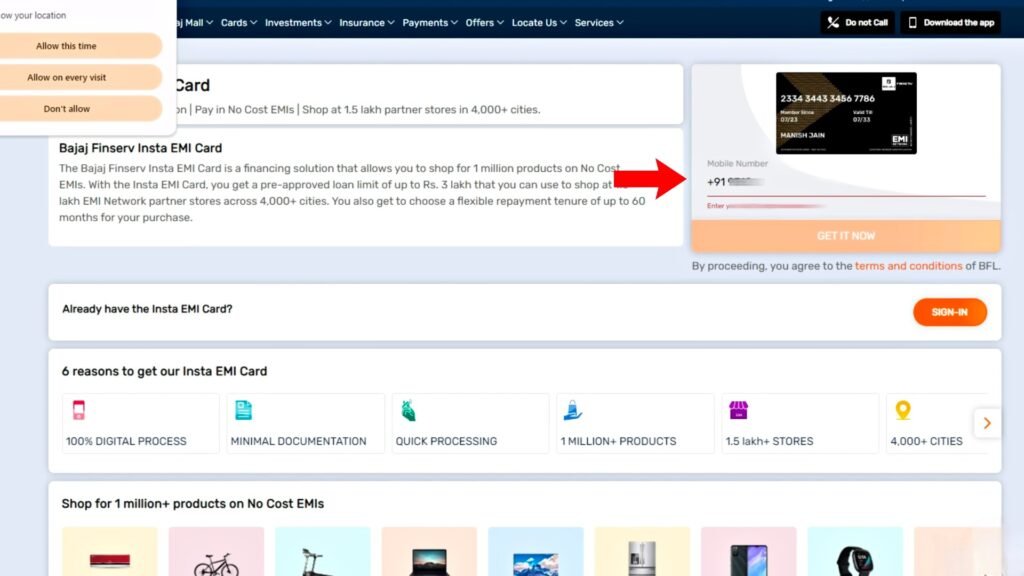

- Apply the phone number to Bajaj Insta Emi Card press the “Get it Button” to apply EMI Card

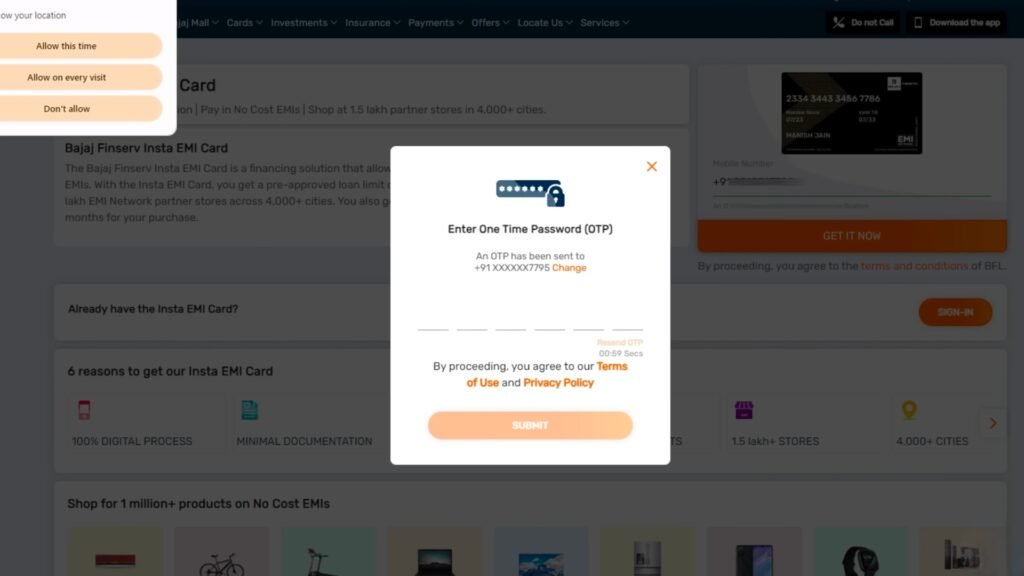

- Paste the “One time password” from mobile Phone. Please refer the Terms of use and Privacy policy

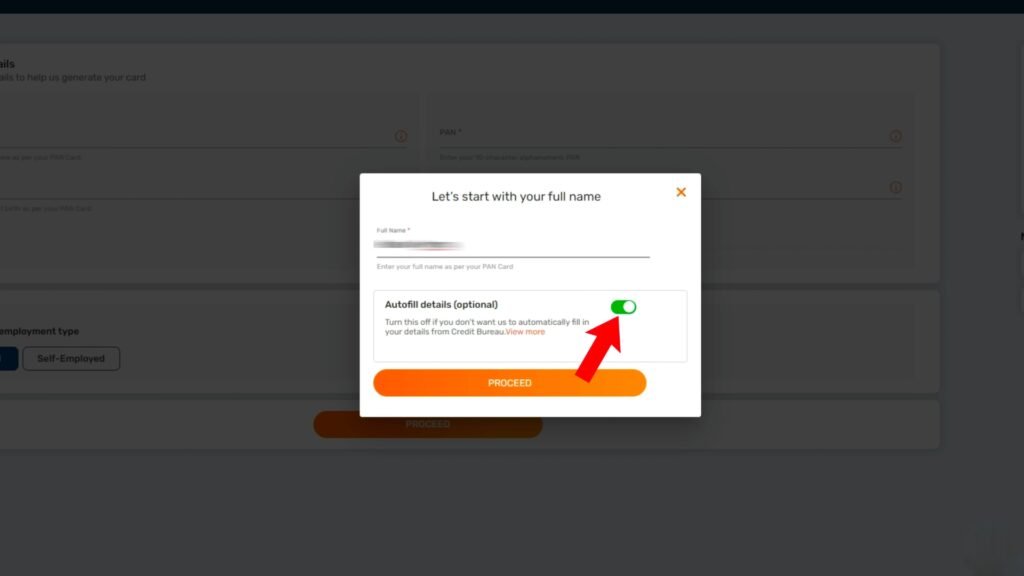

- Fill the data with yourself start’s with your name

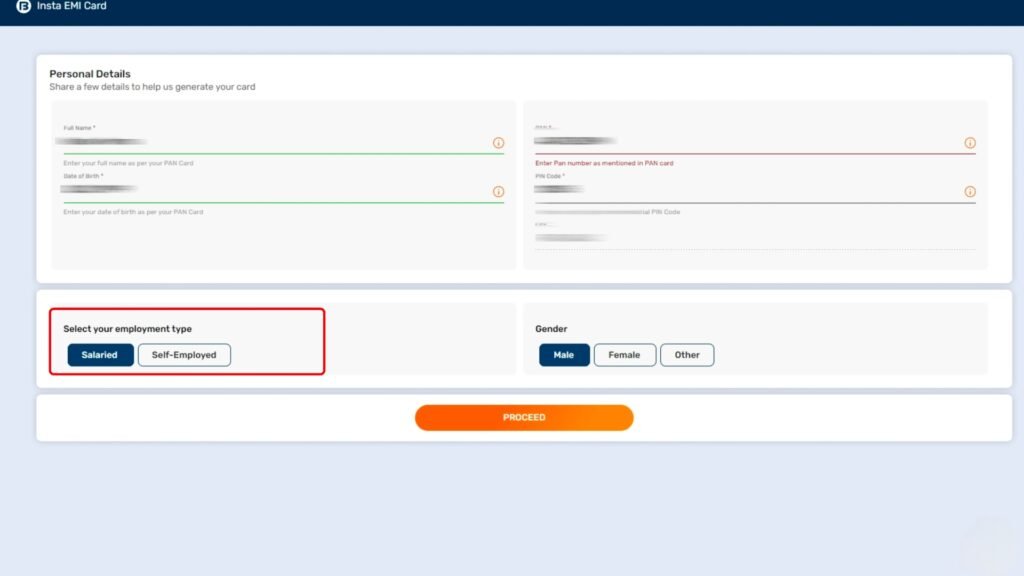

- Please fill the personal details and your employment type confirm to proceed

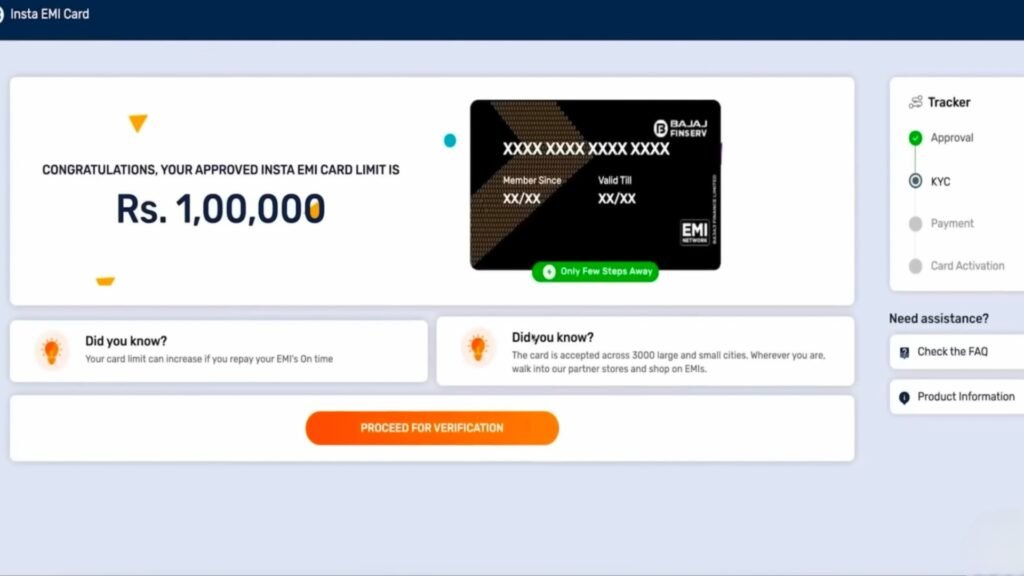

- Bajaj EMI Card after the approval KYC process starts

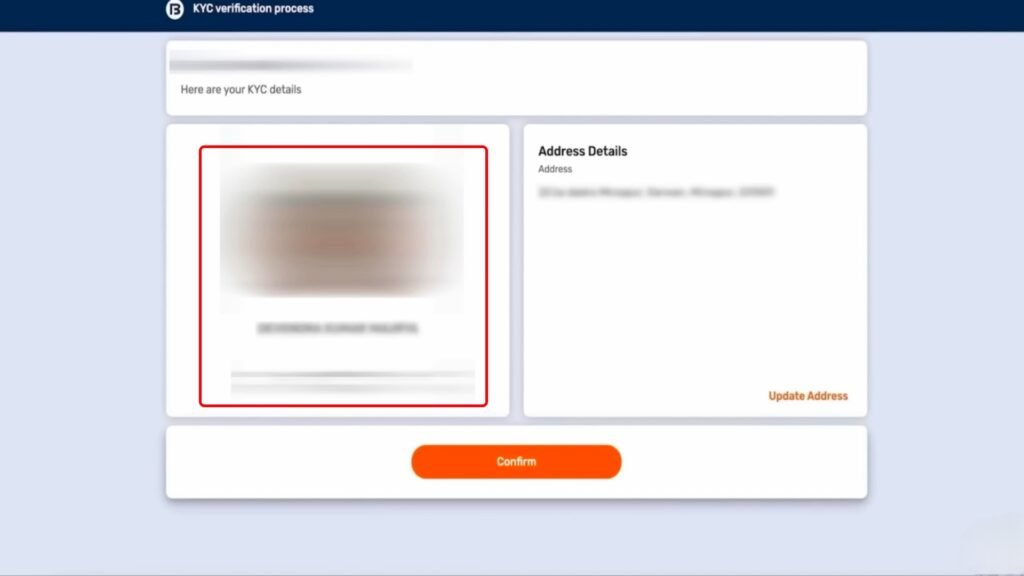

- After Filled the KYC verification Process confirm the details.

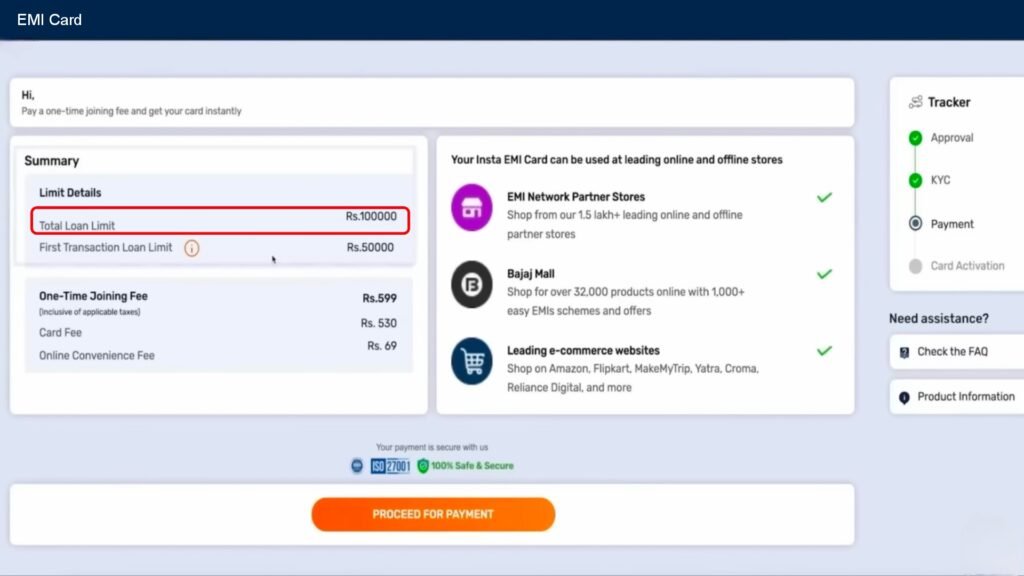

- The EMI Card Loan Limit up to one Lakh Rupees

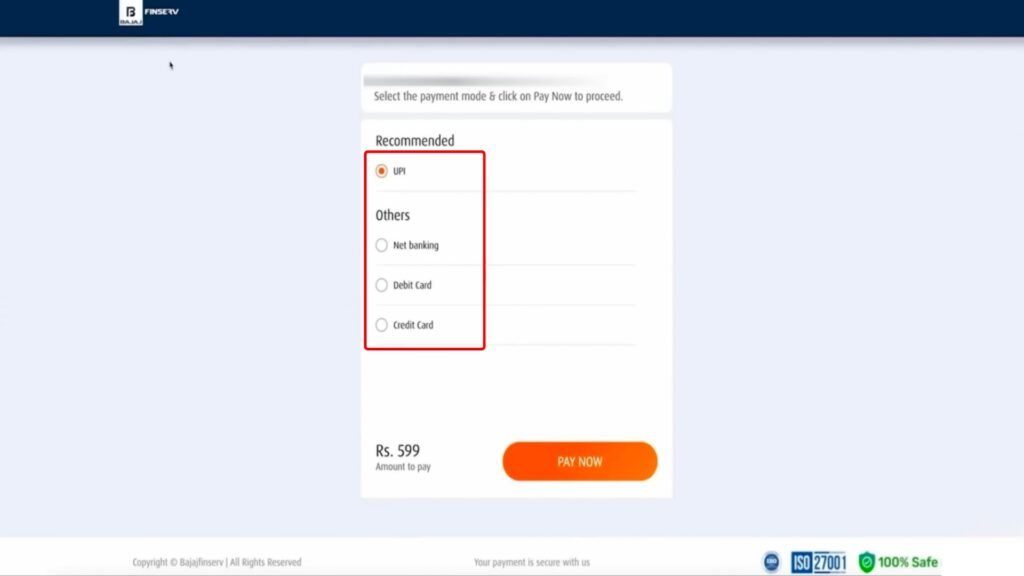

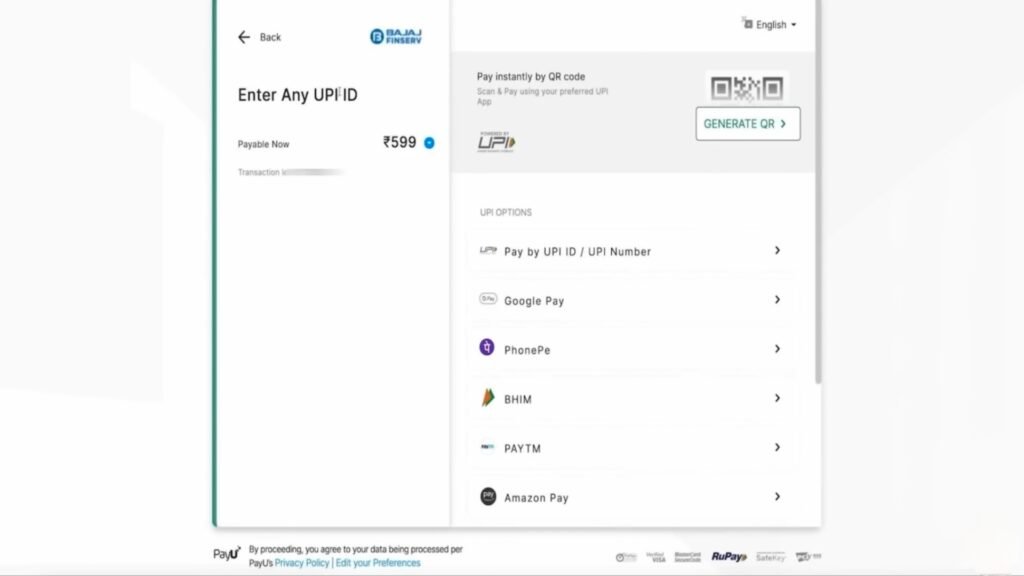

- Select your payment option Recommended to your Bank account

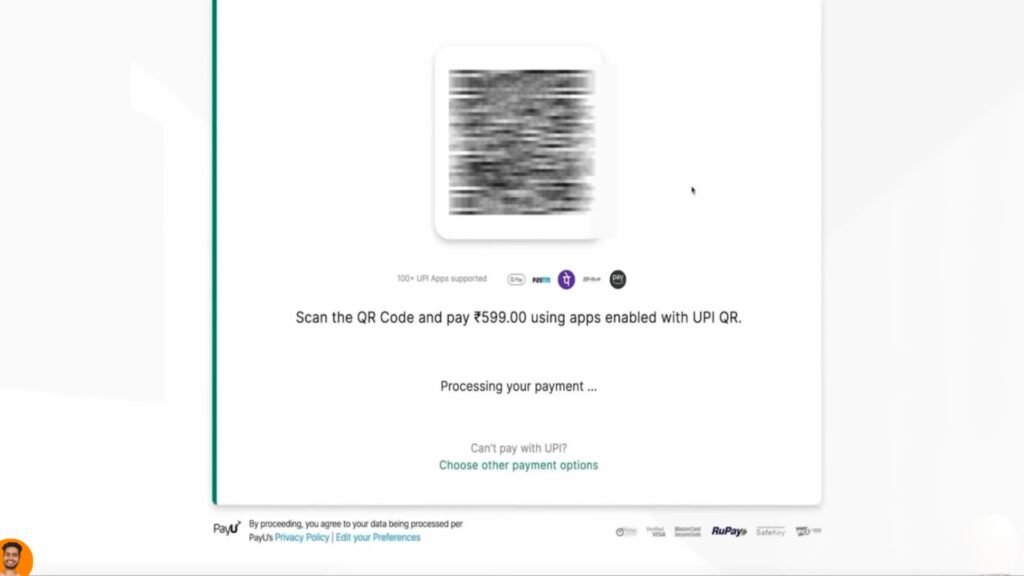

- Generate the QR code for your UPI ID at minimum amount of Bajaj EMI Card

- Payment success on QR Code

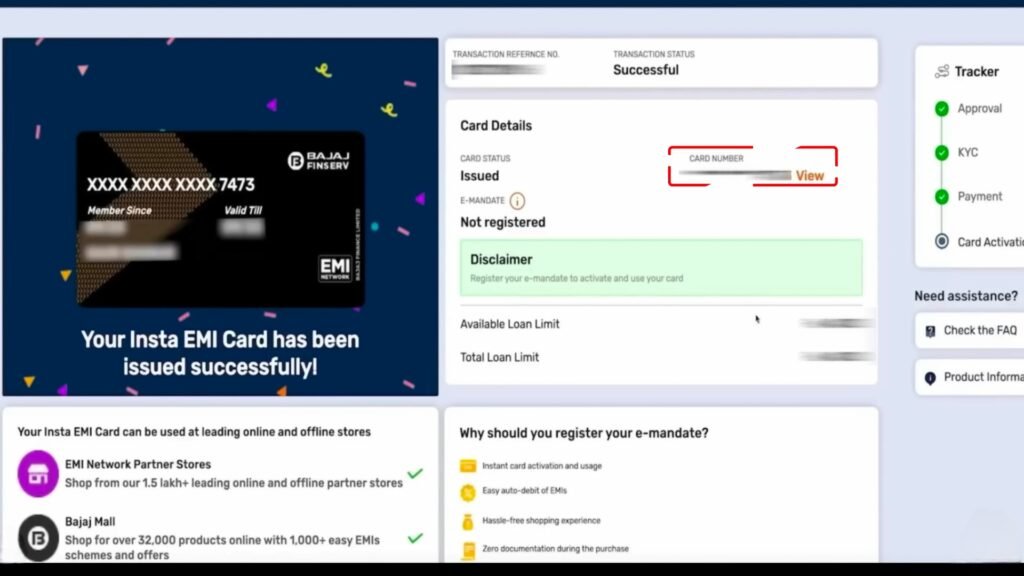

- After Successfully the payment card number visible in BAJAJ FINSERV

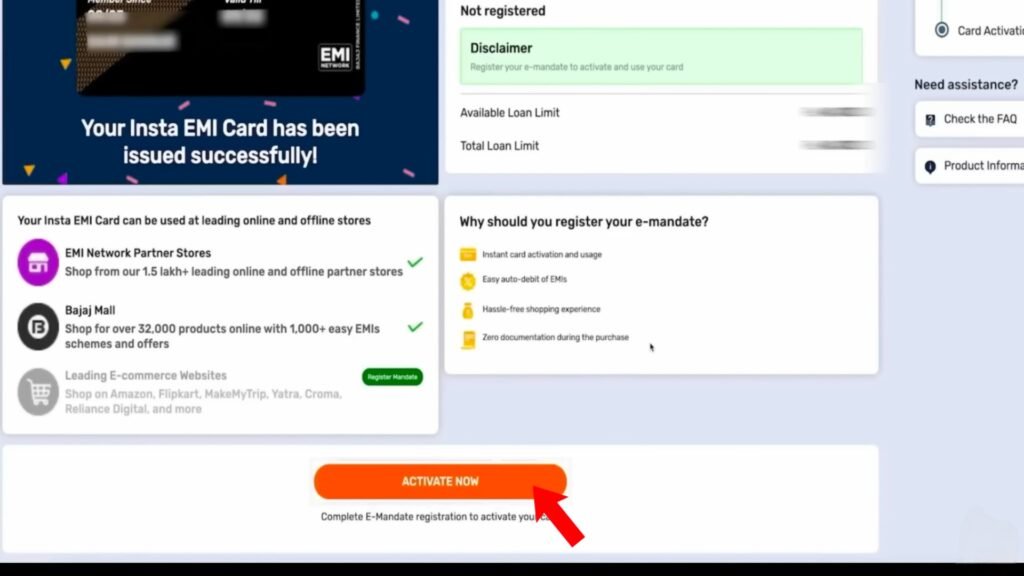

- Here you have a not Registered Disclaimer option and active the registration to active your card

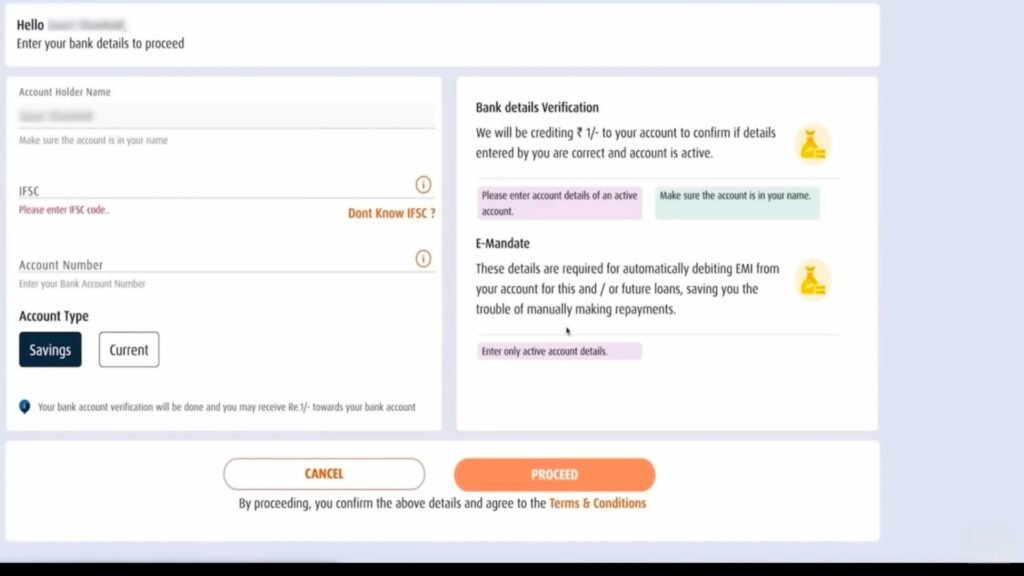

- Now you have to apply the Bank details Account Number, IFSC & Account holder name complete the details press the proceed button

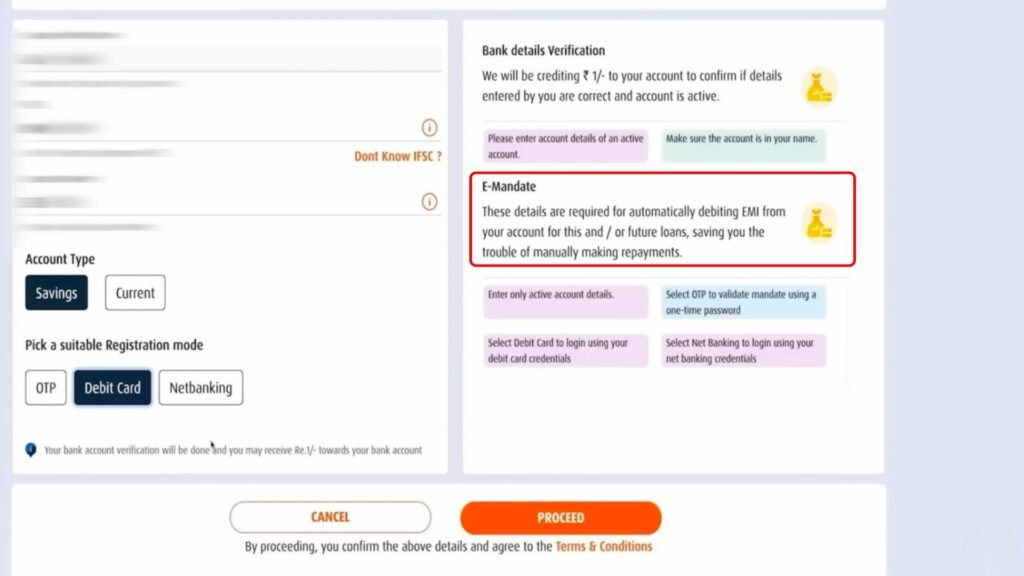

- Make sure of your Account type and pick a suitable Registration mode and press the proceed

- Bajaj Finserv create mandate amount you have to Spend on your card

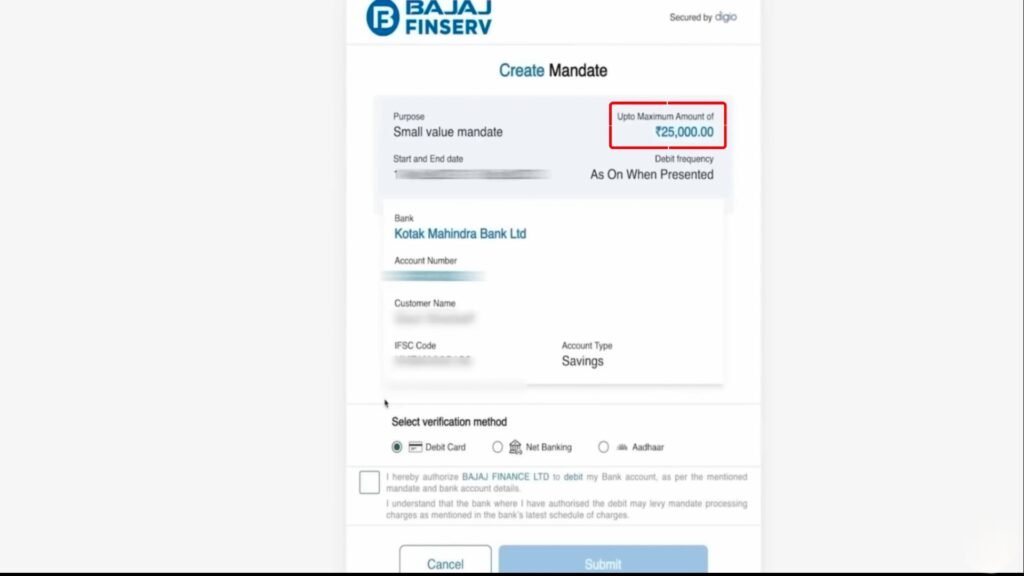

- Here you receive a Thank You using Kotak Banking

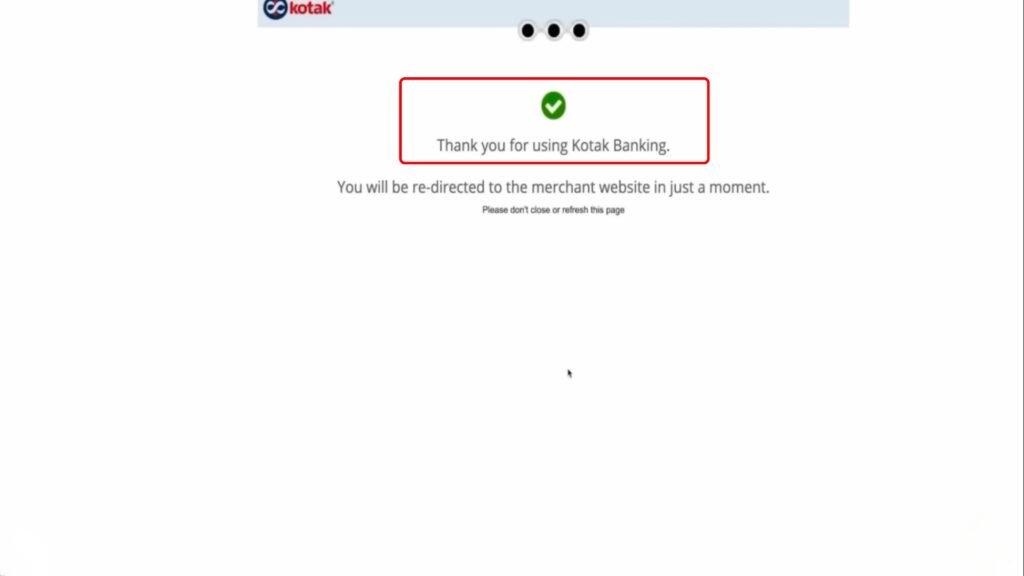

- After the Authentication Success please share your feedback

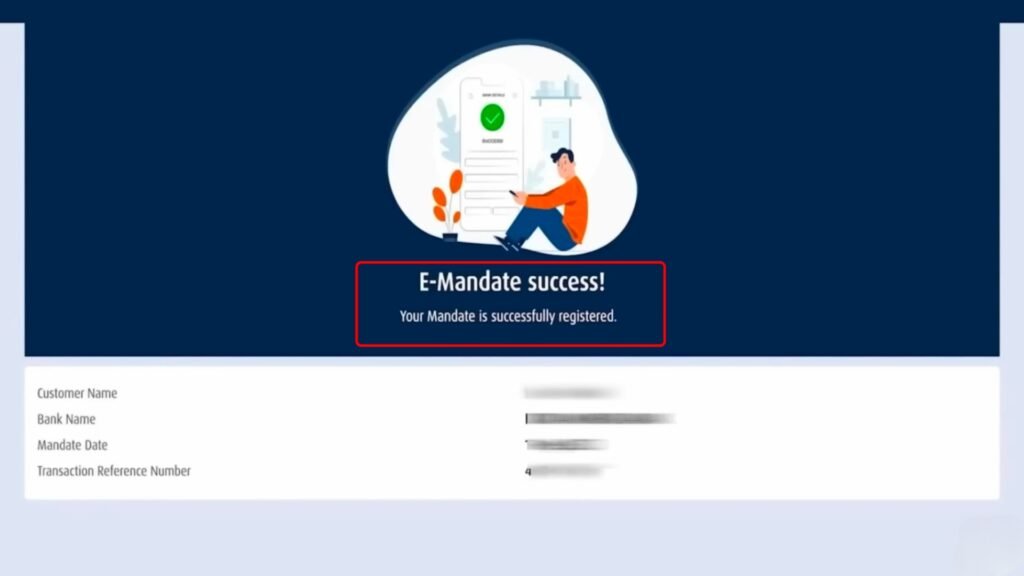

- Here the E-Mandate Success registered for Bajaj EMI-Card

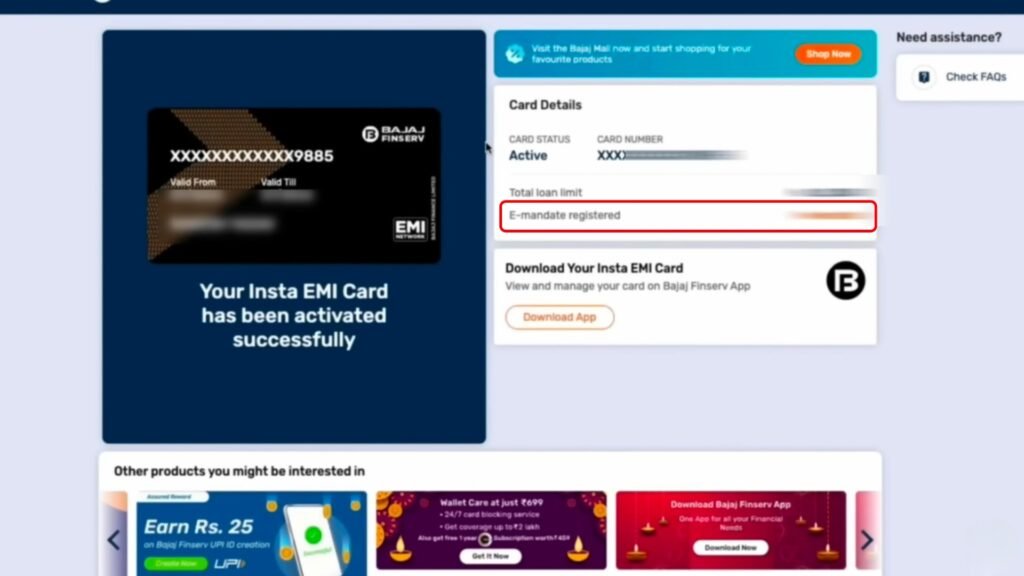

- Insta Bajaj EMI Card has been activated Successfully

Required Documentation for EMI Purchase

When purchasing a mobile phone on Equated Monthly Installments (EMI), specific documentation is required to facilitate the transaction. Commonly required documents include identity proof, such as an Aadhaar card or passport; address proof, which may consist of utility bills or bank statements; and income verification documents like recent pay slips or income tax returns. These documents serve to establish the buyer’s identity, residency, and financial stability.

Lenders may also request additional paperwork for specific scenarios. For instance, self-employed individuals might need to provide business registration certificates along with financial statements. It is imperative that all documentation is current and clearly legible to avoid delays in application processing. Furthermore, it is advisable for buyers to maintain copies of submitted documents for record-keeping purposes throughout the EMI tenure. This ensures transparency in communication with both the seller and lender should any discrepancies arise in future transactions.

Understanding Interest Rates and Fees

Interest rates and fees are critical components of an Equated Monthly Installment (EMI) plan when purchasing a mobile phone. The interest rate, which is the percentage charged on the principal amount borrowed, can vary significantly based on factors such as credit score, loan tenure, and lender policies. A lower interest rate can reduce overall repayment amounts, while a higher rate increases the total expenditure.

In addition to interest rates, various fees may be associated with an EMI plan. These include processing fees—charged for setting up the loan—and late payment fees—incurred when payments are not made by their due dates. It is essential for consumers to examine all associated costs comprehensively before finalizing their financing options. Furthermore, calculating the Annual Percentage Rate (APR), which encompasses both interest and any applicable fees expressed as an annualized figure, provides a more accurate representation of borrowing costs over time. Understanding these elements ensures informed decisions during the mobile phone acquisition process through EMI arrangements.

Managing EMI Payments Effectively

Effective management of Equated Monthly Installments (EMI) requires a systematic approach to budgeting and financial monitoring. A comprehensive assessment of one’s monthly income and essential expenses is essential. This ensures that EMI obligations do not exceed 30% of disposable income, thereby minimizing financial strain during the payment period.

To streamline EMI payments, automated transfers from a primary bank account to the lender can be established. This mechanism reduces the risk of missed payments and potential penalties associated with late fees. Additionally, maintaining an emergency fund that covers at least three months of EMIs provides a safety net in unforeseen circumstances such as job loss or medical emergencies.

Regular review of outstanding loan terms and interest rates is also advised. If favorable terms become available, refinancing options should be considered to reduce total repayment amounts over time. Employing these strategies fosters disciplined financial habits and enhances overall credit health during the tenure of the loan.

Common Mistakes to Avoid on EMI

When purchasing a mobile phone on Equated Monthly Installments (EMI), it is crucial to avoid several common mistakes that can lead to financial strain. One prevalent error is neglecting the total cost of ownership, which includes not only the principal amount but also interest rates and additional fees. It is recommended to calculate the overall expense before committing to an EMI plan. Consumers should examine all terms associated with the financing option in order to ascertain if they align with their budgetary constraints.

Another mistake often made involves overlooking prepayment penalties. Some lenders impose fees for early repayment of EMIs, which can negate any potential savings derived from paying off higher interest loans sooner. Additionally, failing to assess one’s credit score prior to applying for an EMI plan can result in unfavorable terms or rejection of applications altogether. By being mindful of these factors—total cost, prepayment conditions, and creditworthiness—consumers can make more informed decisions that will benefit their financial health over time.

Conclusion: Summary of Key Takeaways

In summary, the purchase of a mobile phone on Equated Monthly Installments (EMI) involves several important factors that should be carefully considered. The buyer must evaluate the total cost of ownership, which includes the principal amount and any applicable interest or fees associated with the EMI plan. It is essential to compare various financing options available in the market to identify one that provides favorable terms and conditions.

Moreover, understanding one’s own financial capacity plays a crucial role in ensuring timely payment without straining personal finances. A comprehensive analysis of monthly income and existing obligations can assist buyers in selecting an appropriate EMI tenure and amount. Additionally, awareness of potential penalties for missed payments or prepayments can inform better decision-making throughout the purchasing process. Engaging with multiple lenders may also unveil promotional offers or discounts, enhancing value while acquiring a device through this payment method.

Looking for a fast and efficient way to resize ICO files? The ICO Resizer is the perfect tool for web developers and designers. It maintains high-quality output and supports multiple image formats. Try it now: ICO Resizer

Hello. . [url=https://nw.dn.ua/]nw.dn.ua[/url]

nw.dn.ua

https://nw.dn.ua zwz4763574